Access the best in global private equity

As Australia’s leading private markets investor, Pacific Equity Partners has launched PEP Gateway to unlock global private equity for individuals. PEP Gateway is a premium strategy offering access to the best in global private equity, with regular liquidity.

Access

Private equity has never been easy to get into or out of. Until now. PEP Gateway provides greater accessibility and liquidity for individual investors

The Best

As one of Australia’s most successful and established private equity firms, PEP is uniquely placed to partner with the best private equity firms in the world

Globally

Now you can diversify your portfolio with global private equity firms that consistently deliver excellent returns

Private markets advantage

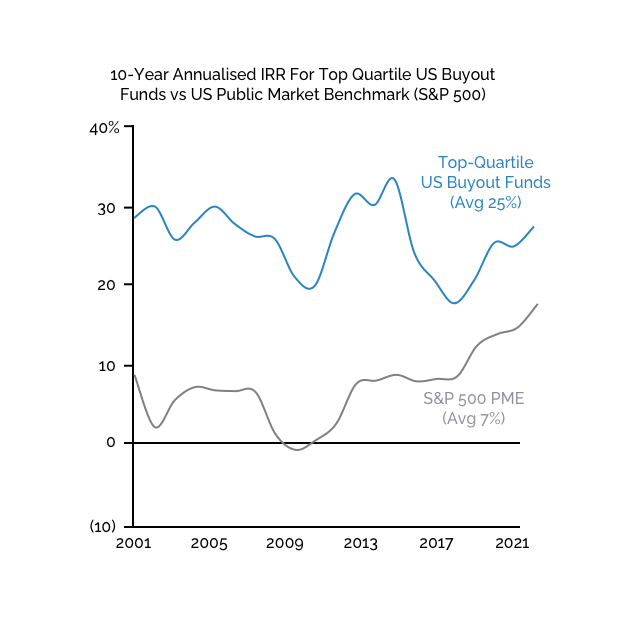

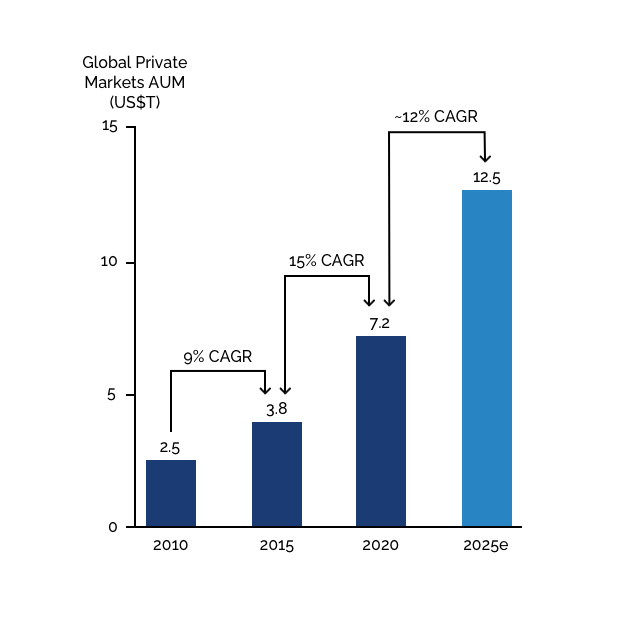

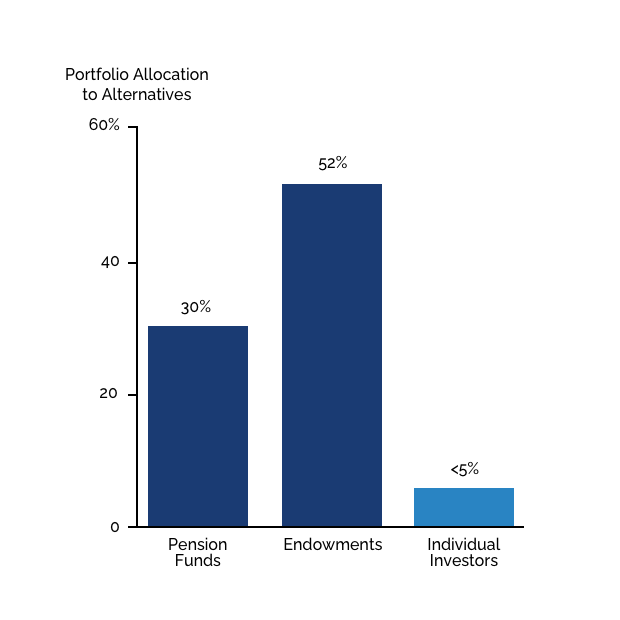

Top-tier global private equity funds have consistently outperformed public markets. While pension funds, endowment funds and other institutional investors have enjoyed the benefits of consistently strong returns and relatively low volatility, individual investors often remain under-allocated. Now, through PEP Gateway, you can also access some of the best private equity firms in the world.

Top tier private equity consistently outperforms

Driving strong growth in private markets

Individuals often remain under-allocated

Note: PME is a public market equivalent based on the Long-nickels methodology

Source: Morgan Stanley Investment Management, World Bank (2021), Bain (2022), Cambridge Associates (2022)

Led by an experienced private markets investor

PEP is one of Australia’s most successful and established private equity firms

Strong, Consistent Returns

41%

average Gross IRR since inception in 19982

2.6x

average Gross MoM since inception in 19982

Largest Australasian PE Firm1

A$18B

assets under management

>240

investments made3

Experienced

Team

>650

years cumulative experience

>27

years of operation with unchanged founding team

All figures in Australian Dollars (AUD). All figures at 31 March 2025 (unless stated otherwise). 1. Preqin (Largest Fund Manager by Funds Raised with geographic focus of Australasia). 2. Simple arithmetic average at Fund level for Private Equity Funds I-VI and Secure Assets Fund I. 3. >40 platform investments and >190 bolt-ons.

Investment highlights

Access to the best in global private equity, with regular liquidity

Access

Exposure to a high quality global private equity portfolio with a low minimum investment amount

Attractive returns

Top-tier private equity has delivered consistently strong returns

Diversification

Carefully constructed portfolio with diversification across PE firm, geography and industry sector

Regular liquidity

Monthly subscriptions & withdrawals

PEP as manager

One of Australia’s leading private markets investors

Research ratings

| PEP Gateway Evergreen (Access Fund) received a ‘Recommended’ rating from Lonsec Research (October 2025) |

Disclaimer: The rating published on 10/2025 for (PEP3457AU) is issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). Ratings are general advice only and have been prepared without taking account of investors’ objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec Research assumes no obligation to update. Lonsec Research uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2025 Lonsec. All rights reserved.

How to invest

PEP offers two access points for individuals looking to invest in global private equity

PEP Gateway Evergreen

A$50,000

Monthly applications & redemptions

Open-ended

Diversified portfolio of high quality global private equity investments, including with many of the world’s best private equity firms

Wholesale Investor

PEP Gateway Access Fund (Australian Unit Trust)

Netwealth (In Progress), Hub24 (In Progress), Praemium (In Progress), CFS Edge, FNZ, Apex, Adminis, Clearstream

PEP Gateway Vintages

A$250,000

No redemptions; liquidity subject to investment realisations with 5-7 year expected hold

Closed-ended; annual series

~10 direct global private equity investments per annual series, comprising attractive continuation vehicles and co-investments

Wholesale Investor

PEP Gateway Vintage Access 2026

Netwealth (In Progress), Hub24 (In Progress), Praemium (In Progress)

*The PEP Gateway NZ PIE Fund is available only to persons who are “Wholesale Investors’, as defined in clause 3(2) and 3(3)a) of Schedule 1 of the Financial Markets Conduct Act 2013 (FMCA) or to persons who are not otherwise required to receive disclosure under Part 3 of the FMCA. If you are a Wholesale Investor, as defined by the FMCA, the usual rules do not apply to offers of financial products made to you. As a result you may not receive a complete and balanced set of information. You will also have fewer other legal protections for these investments. Ask questions, read all documents carefully, and seek independent financial advice before committing yourself.

In the spirit of reconciliation Pacific Equity Partners acknowledges the Traditional Custodians of country throughout Australia and their connections to land, sea and community. We pay our respect to their Elders past and present and extend that respect to all Aboriginal and Torres Strait Islander peoples today.